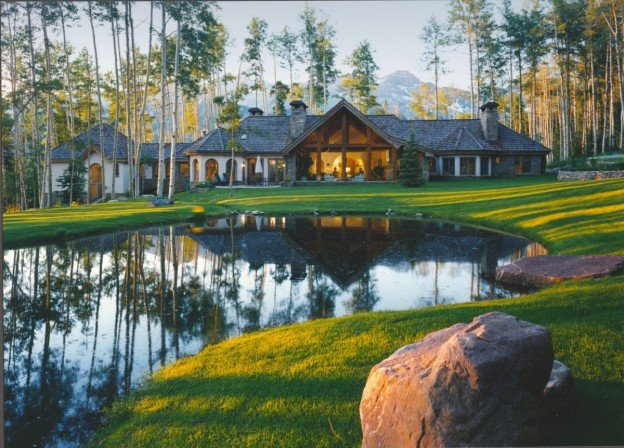

In this column i focus on vacation homes that are classified as rental properties for federal income tax purposes. Do not count such a day as a day of personal use even if family members use the property for recreational purposes on the same day.

Qualified Business Income Deduction For Rental Property Squar Milner

415 renting residential and vacation property if you receive rental income for the use of a dwelling unit such as a house or an apartment you may deduct certain expenses.

What is a vacation home for tax purposes. The tax law even allows you to rent out your vacation home for up to 14 days a year without paying taxes on the rental income. Tax rules are a bit trickier when you use your vacation home yourself for more than 2 weeks and also rent it out for a substantial part of the year. Learn more about the tax rules for renting your vacation home for part of the year from the experts at hr block.

As with everything tax related meticulous. Do you need to report every stock trade on a schedule d for tax purposes. Heres what you need.

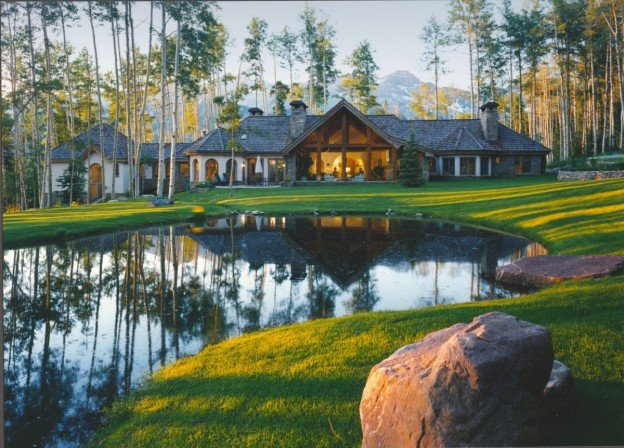

If youre thinking about buying a second home for vacations rental income or an eventual retirement residence it makes financial sense to take advantage of all the available tax breaksthe. Vacation home rental tax rules. You might be able to deduct any uninsured casualty losses too if the home is located within a presidentially declared disaster area though you cant write off rental related expenses.

These expenses which may include mortgage interest real estate taxes casualty losses maintenance utilities insurance and depreciation will reduce the amount of rental income thats subject to tax. Tax rules for renting out your vacation home. Learn more from the tax experts at hr block.

As it turns out the changes in the tax cuts and jobs act tcja dont have. If you own a vacation home that you use for both rental and personal purposes now is a good time to plan how to use it for the rest of this year with tax savings in mind.

Tax Basics For Newly Separated Parents Moneysense

Will You Pay Capital Gains Taxes On A Second Home Sale Millionacres

Real Estate 101 How Rental Properties Are Taxed Millionacres

4 Tax Deductions That Are Amazing For Homeowners

Here S What To Do If You Re Inheriting A House

Capital Gains Tax On Second Homes John Charcol

Publication 936 2019 Home Mortgage Interest Deduction

Tax Rules For Renting Out Your Vacation Home

14 Millennials Got Honest About How They Afforded Homeownership

How To Give Your Home To Your Adult Child Tax Free Marketwatch

Primary Secondary And Investment What To Know When Buying

:max_bytes(150000):strip_icc()/GettyImages-1028791520-af4073a4820d40599d8d9c0b5b446ed4.jpg)

Tax Rules For Renting Out Your Vacation Home

A Guide To Florida Homestead Laws

/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

How To Get Rid Of An Irs Tax Lien On Your Home Bankrate Com

Tax Breaks For Second Home Owners T D Smith

Cash Out Refinance Tax Implications Rocket Mortgage

Most Overlooked Tax Breaks And Deductions For The Self Employed

:max_bytes(150000):strip_icc()/GettyImages-1148171551-a60119b7ac2c4653b12c48b4e40b2b81.jpg)

Tax Breaks For Second Home Owners

Rental Property Deduction Checklist 20 Tax Deductions For

How To Claim Tax Benefits On More Than One Home Loan

No comments:

Post a Comment