Due to us tax laws and tax benefits owning a vacation home is actually more affordable than you might think. You need to deduct expenses in this specific order.

Top 15 Tax Deductions For Landlords

415 renting residential and vacation property if you receive rental income for the use of a dwelling unit such as a house or an apartment you may deduct certain expenses.

Vacation home taxes deductible. Tax deductible interest is a borrowing expense that a. I explained to him that the tax code is very granular when it comes to vacation homes. This limitation can affect your ability to claim itemized deductions for property taxes on a vacation home.

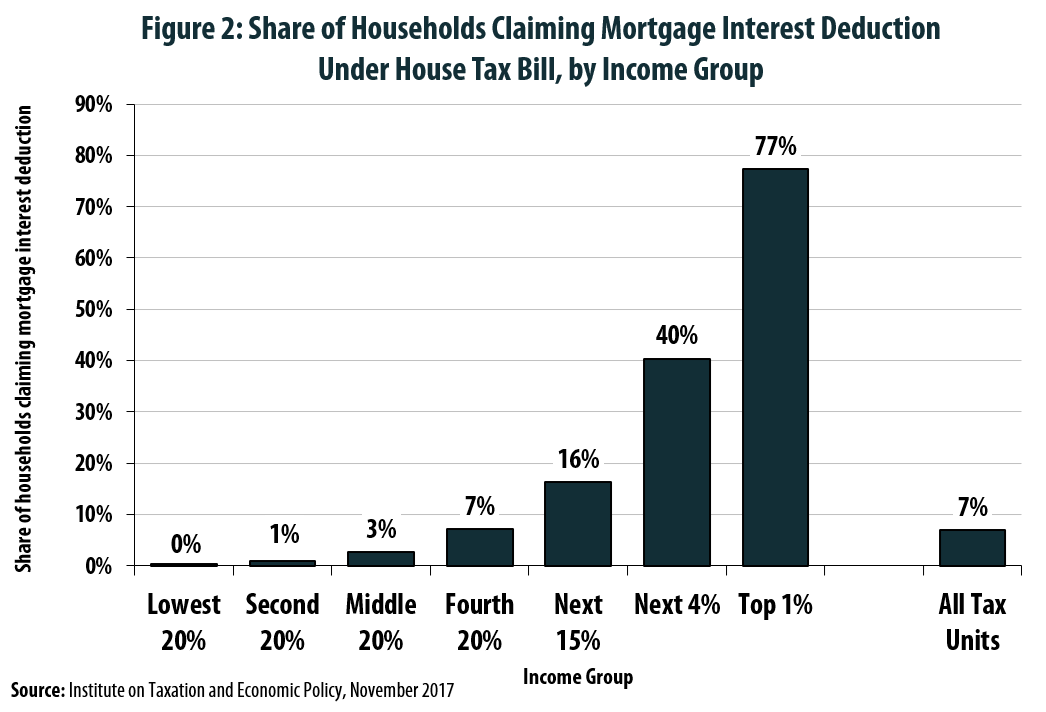

Thats because the rules on deductions for owning a second home will change in 2018 once the just passed tax bill takes. Take a vacation or buy a second home. These rules limit deductible expenses to rental income.

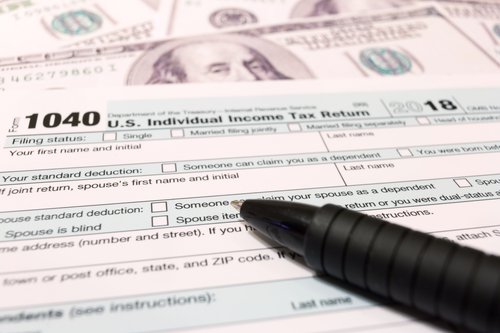

Qualified home mortgage interest. This means you can deduct mortgage interest and property taxes as you would with any home. The rental portion of.

If you rent out your home for at least 15 days and the days of personal use qualify your home as a residence vacation home rules apply. Or 375000 if married filing separately. If the home was acquired after december 15 2017 the home acquisition debt limit is 750000.

State and local real property taxes are generally deductible. Your vacation home falls into this category if you. These expenses which may include mortgage interest real estate taxes casualty losses maintenance utilities insurance and depreciation will reduce the amount of rental income thats subject to tax.

No matter your goals for a second home understanding the tax breaks for your vacation residence can help you relax in style. A client recently asked me about the tax implications of buying a vacation home somewhere far away from los angeles renting it out on airbnb part of the year and taking a 2 week family vacation there once a year. How many days you use a vacation home for personalfamily use vs.

Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare. Despite the provisions of the tax cut and jobs act the irs in a 2018 advisory states that home equity loan interest is still deductible as is interest on helocs and second mortgages. The tax law even allows you to rent out your vacation home for up to 14 days a year without paying taxes on the rental income.

The 40 is non deductible. You might be able to deduct any uninsured casualty losses too if the home is located within a presidentially declared disaster area though you cant write off rental related expenses. If you are thinking of buying a second home you may want to think again.

How many days you use.

Publication 936 2019 Home Mortgage Interest Deduction

The Benefits Of Buying A Vacation Rental As A Real Estate Investment

Second Home Vs Investment Property Comparing The Tax Differences

Guide To Residential Real Estate Deductions For 2018

Paradise Or Money Pit What You Ll Pay In Taxes When Buying A Home

Real Estate Tax Deduction Millionacres

Tax Breaks For Second Home Owners

8 Rental Tax Deductions You Should Use For Your Vacation Properties

How To Write Off Travel On Your Taxes Travel Traveling By

5 Tax Benefits Of Owning A Second Home Realtor Com

Real Estate Tax Deduction Millionacres

Primary Secondary And Investment What To Know When Buying

Homeowner Deductions Guide And Overlooked Tax Write Offs Pennymac

Vacation Rental Property Tax Deductions Rules For 2019

Tax Benefits Of Buying Owning And Selling A Home Nerdwallet

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips

Are Home Equity Loans Tax Deductible Lendedu

Mortgage Interest Deduction Wiped Out For 7 In 10 Current

Vacation Rental Property Tax Deductions Rules For 2019

Overlooked Tax Breaks For Retirees

Can I Deduct Mortgage Interest On My Timeshare Finance Zacks

No comments:

Post a Comment