Chapter 3 Accounting Taxation And Finance

:max_bytes(150000):strip_icc()/gettyimages_186178398-5bfc376cc9e77c0026337414.jpg)

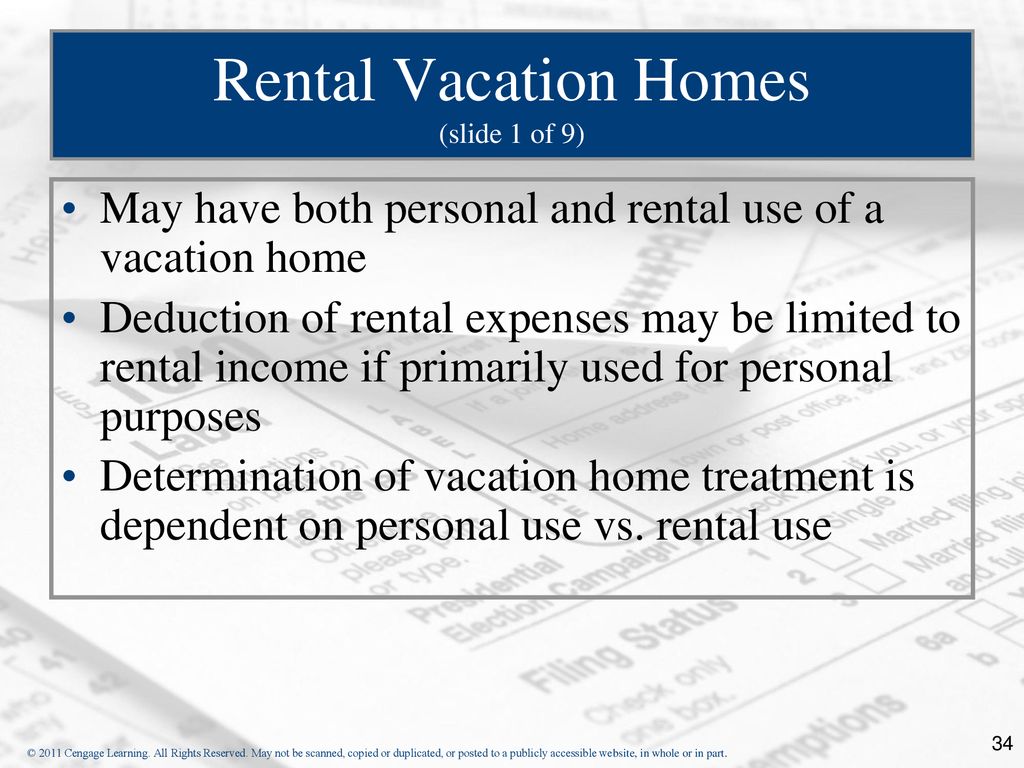

Tax Rules For Renting Out Your Vacation Home

Renting Out The Cottage Don T Miss Out On 11 Tax Deductible Expenses

Vacation Rental Property Tax Considerations Part 2 The Kane Firm

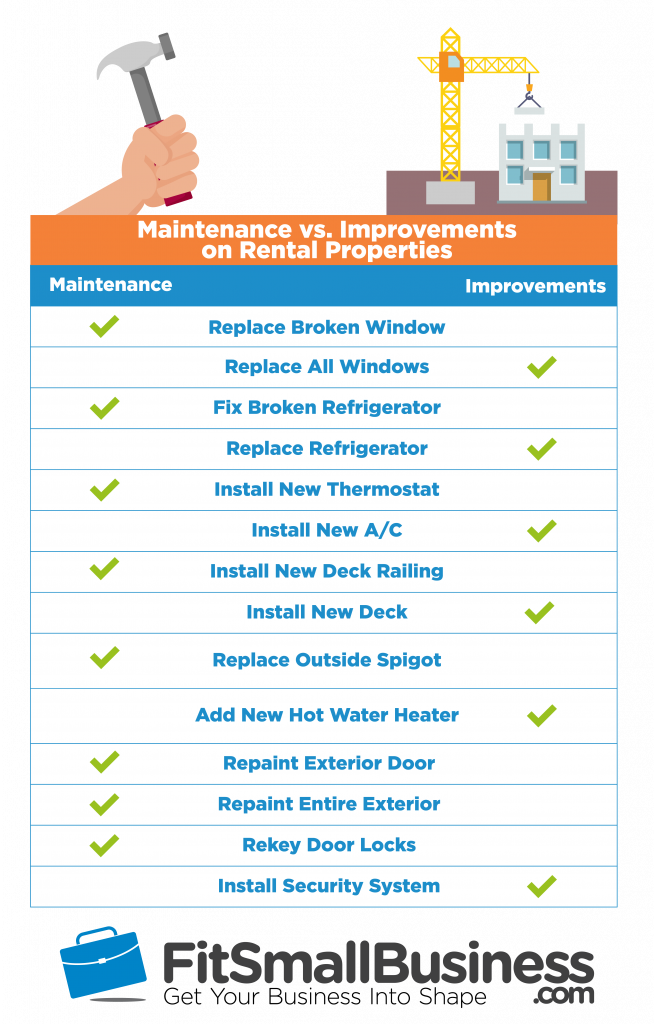

Top 12 Rental Property Tax Deductions Benefits 2019 Free

The Benefits Of Buying A Vacation Rental As A Real Estate Investment

4 Crucial Guidelines For Deducting Your Vacation Travel Expenses

You Might Save Tax If Your Vacation Home Qualifies As A Rental

8 Deductible Vacation Rental Property Expenses

Financial Considerations For Vacation Home Owners Intracoastal

Publication 463 2019 Travel Gift And Car Expenses Internal

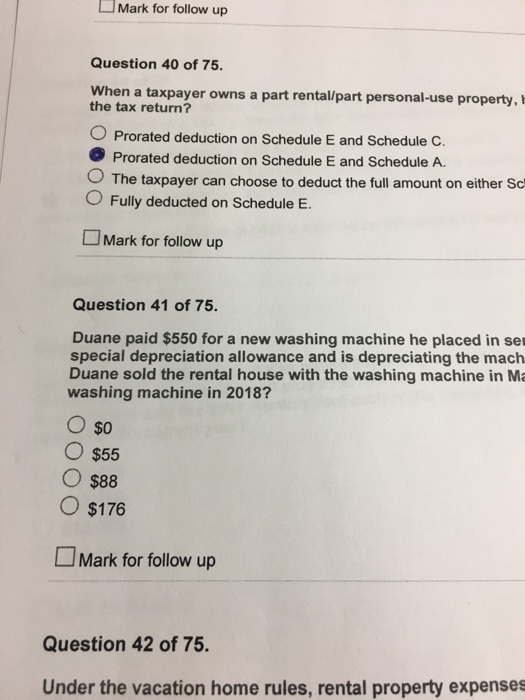

Mark For Follow Up Question 40 Of 75 When A Taxpa Chegg Com

Tcja Tax Reform And Your Vacation Rental Home Maloney Novotny

Vacation Home Taxes Second Home Buying Tips And Articles

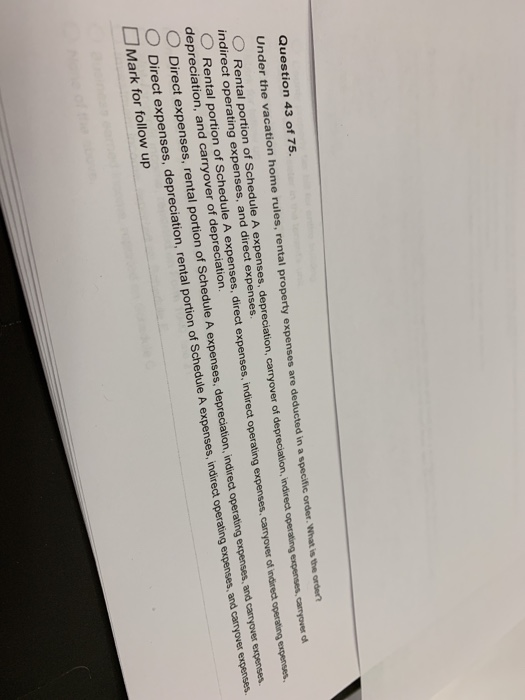

Solved Question 43 Of 75 Under The Vacation Home Rules

The Pros And Cons Of Investing In Vacation Rental Properties

How To Rent Out Your Vacation Home And Not Get Slammed By The Irs

How To Avoid Capital Gains Taxes When Selling Your House 2020

Real Estate Tax And Rental Property Turbotax Tax Tips Videos

Tax Rules For Renting Out Your U S Vacation Home

Deductions And Losses In General Ppt Download

Claiming A Loss On Personal Residence Converted To Rental Property

Second Home Vs Investment Property Comparing The Tax Differences

:max_bytes(150000):strip_icc()/GettyImages-1028791520-af4073a4820d40599d8d9c0b5b446ed4.jpg)

Tax Rules For Renting Out Your Vacation Home

Vacation Home Rental Tax Rules H R Block

No comments:

Post a Comment