However you would still need to pay taxes on depreciation recapture at this point. Taxpayer owns second home rented out say 100 days one year used personally 30 days same year.

Property Depreciation Why It Could Come Back To Bite You

Vacation rental the tax treatment of vacation rental.

Sale of vacation home depreciation carryover. Disallowed operating expenses and depreciation carried over to the next year. With this in mind practitioners need to be up to speed on the vacation rental rules. The code and pubs are silent on what to do with the carryover if the vacation home rental is sold.

Bolton is a well known tc case having to do with allocating expenses between schedule a e. Even an option in proseries tax sw. Still the question is if have 26k of carryover vacation home depreciation is that added to basis upon saleper harry.

Practitioners should also be aware of a new provision effective january 1 2009 that potentially reduces the gain exclusion on sale of a residence that was previously used as a vacation home or rental. Another vacation home question hopefully last one. Each year the losses have been limited to rental income due to the personal days of use.

Home used mostly by the owner. So if your gain was 50k your carryover loss was 20k and your total depreciation taken was 300k i understand youd have to pay capital gains tax on 30k 50 30 plus 25 tax on the 300k depreciation recapture. Client used a vacation home as part rental and part personal.

If the home is your main home and you rent it out for fewer than 15 days during the year you dont need to report income. If it were mine i would not show the depreciation recapture on the sale since it was never deducted in the first place. If so prorate the expenses you incur between personal and rental use.

Since vacation homes usually get this kind of treatment the rules you must follow are known as vacation home rules. In 2014 the property was sold and my tax program did not automatically deduct the carryover losses due to the following explanation in the program.

How The New Tax Law Affects Vacation Home Owners Marketwatch

How To Report The Sale Of A U S Rental Property Madan Ca

How To Report The Sale Of A U S Rental Property Madan Ca

The New Tax Law Gives Rental Property Owners Some Breaks And One

How To Report The Sale Of A U S Rental Property Madan Ca

Publication 946 2018 How To Depreciate Property Internal

Facing A Huge Gain From A Realty Sale Ahcpa Ahcpa

Video Mortgage Interest Deductions For Rental Property

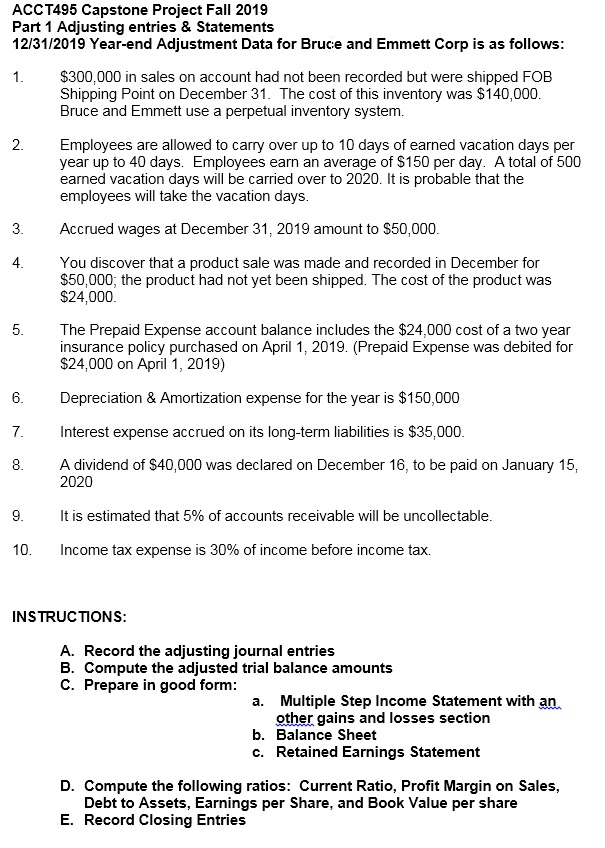

Acc T495 Capstone Project Fall 2019 Part 1 Adjusti Chegg Com

Publication 587 2018 Business Use Of Your Home Internal

Dividing Property After Divorce The Option Of 1031 Exchange

Home Accessories Business Plan 1843 20180912135353 49 Vacation

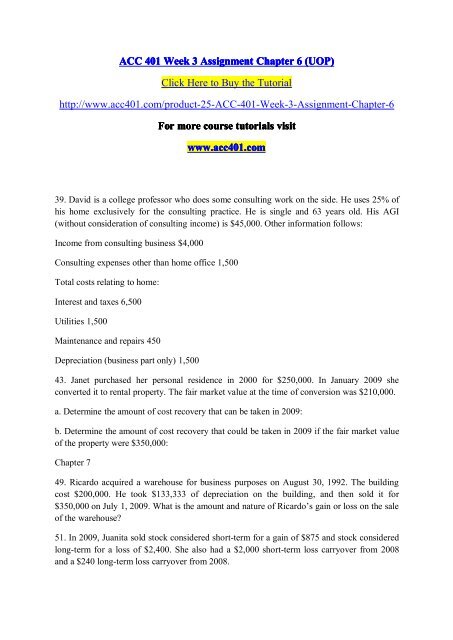

Acc 401 Week 3 Assignment Chapter 6 Uop Acc401dotcom

Can I Sell My House Reinvest In Another House And Not Pay Taxes

Vacation Home Deduction A Tax Guide

Understanding Depreciation Recapture Taxes On Rental Property

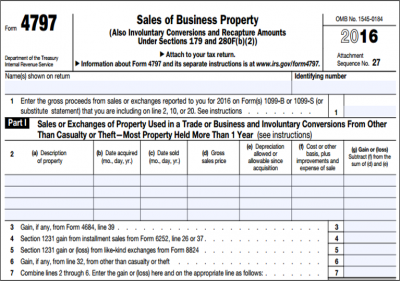

Form 4797 Sale Of Assets The Good The Bad And The Ugly

Understanding Depreciation Recapture Taxes On Rental Property

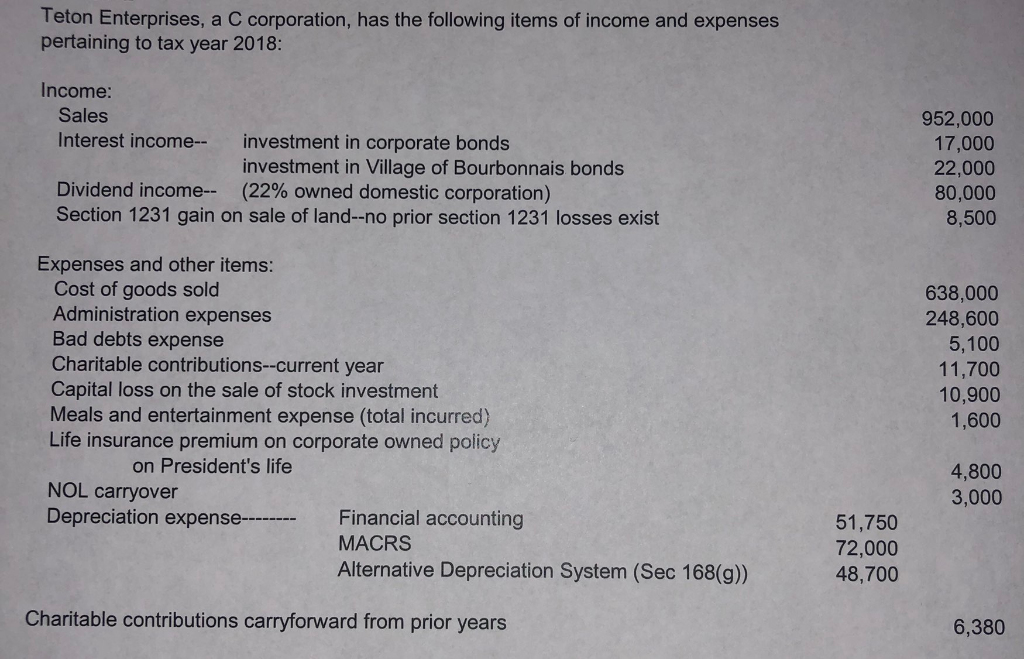

Teton Enterprises A C Corporation Has The Follow Chegg Com

Schedule E Screen Drake16 Schedulee

Top 12 Rental Property Tax Deductions Benefits 2019 Free

Https Apps Irs Gov App Vita Content Globalmedia Teacher 10 Capgains Instructor Presentation Pdf

Timeshares And Taxes Income And Losses For Rental Property

No comments:

Post a Comment