How To Avoid Capital Gains Taxes When Selling Your House 2020

/GettyImages-857304768-3c9bcb9258304ace89a29629cfdc6edf.jpg)

How Does A Host Pay Airbnb Taxes

Selling And Perhaps Buying A Home Under The Tax Cuts And Jobs

Tax Deductions For Vacation Homes Depend On How Often You Use It

Irs Rules For Deductibility For Personal Use Of Rental Properties

How Is Corporate Housing Taxed Is It Tax Deductible

Five Tips To Avoiding The Tax Hazards Of Renting To Relatives

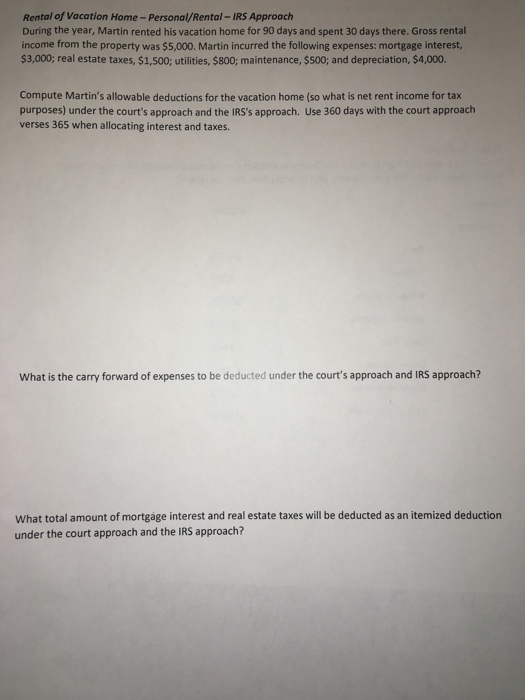

Solved Rental Of Vacation Home Personal Rental Irs Appro

Louisvillevacationhome Com The Irs Allows Every Homeowner To

Health Care Is Shockingly Expensive Why Can T You Deduct It All

Vacation Homes Under The New Tax Law Dermody Burke Brown

How Many Allowances To Claim On Form W 4 Liberty Tax

Tax Benefits For When You Use Your Second Or Vacation Home As A

15 Questions Answered About Flood Damage The Cpa Journal

Real Estate Tax And Rental Property Turbotax Tax Tips Videos

Publication 527 2019 Residential Rental Property Internal

Repairs Vs Improvements What Can I Deduct From My Taxes

/iStock-638210770-5a79ec4d6edd6500368bf4e3.jpg)

Tax Deductible Nonprescription Drugs Or Supplements

2019 Irs Federal Income Tax Brackets And Standard Deduction Updated

Buying A Second Vacation Home Pros Cons Things To Consider

:max_bytes(150000):strip_icc()/gettyimages_186178398-5bfc376cc9e77c0026337414.jpg)

:max_bytes(150000):strip_icc()/shutterstock_596723786.duplex.house_.twofamily.cropped-5bfc3c6ec9e77c0051483b25.jpg)

No comments:

Post a Comment