If so prorate the expenses you incur between personal and rental use. Rental services like airbnb and vrbo can make renting a vacation home seem easy.

Airbnb Host Bundle Vacation Rental Bundle Guestbook House Manuel

Vacation home rental tax rules.

Vacation home rules. How many days you use a vacation home for personalfamily use vs. Different tax rules apply depending on whether your second home is considered a personal residence or rental property. 5 irs rules for renting out your vacation home.

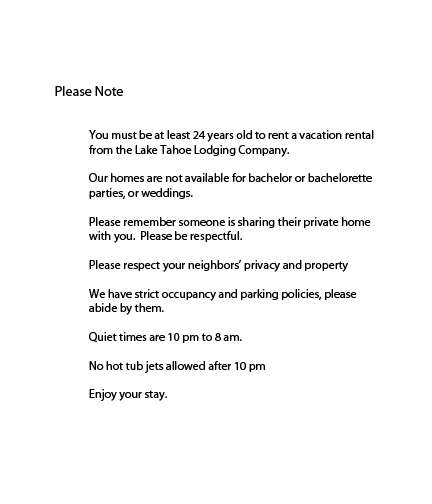

In order to set the tone for the rest of your vacation rental house rules you need to open with a friendly welcome note which guests will read upon arrival. If you live in your vacation home for the other 30 days of the year your vacation home is also a dwelling unit used as a residence unless you rent your vacation home to others at a fair rental value for 300 or more days during the year in this example. You used to enjoy spending all your free time at your beach house but now that the kids are grown and gone you and your spouse have found other ways to vacation.

Chapter 5 discusses the rules for rental income and expenses when there also is personal use of the dwelling unit such as a vacation home. The tax breaks are contingent on meeting irs requirements which can. A day of personal use of a dwelling unit is any day that its used by.

How youre taxed and what expenses you can deduct depend on the amount of time you use the property yourself. Vacation homeowners that rent out their properties are allowed tax benefits to help make the vacation home more affordable. Second home as full time rental.

If you limit your personal use to 14 days or 10 of the time the vacation home is rented it is considered a business. You might own a home that you live in part of the year and rent out part of the year. How many days you use.

But the tax rules are still complicated. This will help guests understand from the outset exactly what is expected of them. Take a vacation or buy a second home.

I explained to him that the tax code is very granular when it comes to vacation homes. In this short introduction to your property its important to highlight the general rules about your home. Since vacation homes usually get this kind of treatment the rules you must follow are known as vacation home rules.

A client recently asked me about the tax implications of buying a vacation home somewhere far away from los angeles renting it out on airbnb part of the year and taking a 2 week family vacation there once a year. Finally chapter 6 explains how to get tax help from the irs.

1031 Exchange Primary Residences Vacation Homes Accruit

Cabin Rules 9 X12 Metal Sign Wall Decor For Vacation Home

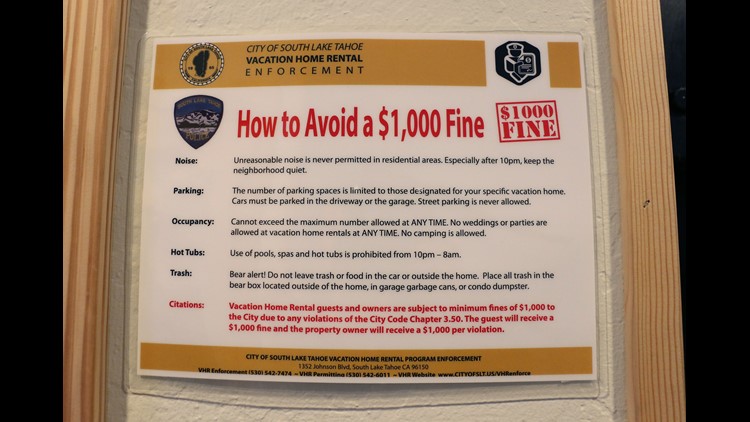

Updated Info On Vacation Rentals In South Lake Tahoe

Crow Wing County Considers Rules For Vacation Rentals Mpr News

Tax Rules On Vacation Home Rentals Baltimore Cpa

Lake House Rules Metal Sign Wall Decor For Vacation Home Etsy

Vacation Homes Tax Rules Don T Get Screwed By The Irs Youtube

Tax Rules On Renting Your Vacation Home Fox Business

Vacation Rental Agreement 9 Steps To A Perfect Short Term Rental

Vacation Home Guest Screening Be Rather Safe Than Sorry Cuddlynest

Guest Book A Lake House Guestbook For Vacation Home Or Airbnb

Rules To Live By When Sharing A Vacation Home With Your Extended

High Quality Images For Vacation Home Rules 1pattern7wall Cf

St Louis County Seeks Comments On Proposed Rules For Vacation

What Are The Tax Rules For Vacation Rental Property

Sample Rental Rules Contract I Cottage Rental Rental Vacation

Here S How South Lake Tahoe Became Home To The 2 000 Parking Fine

Lake House Rules Quotes Sign Coastal Living Summer Vacation Etsy

Tax Rules On Renting Your Vacation Home

Vacation Rental House Rules Template Download Pdf

Vacation Rental Tax Rules Fresno Cpa

Bend S Good Neighbor Guidelines Bend Vacation Rentals

City To Tackle Vacation Home Rules Local News Record Eagle Com

No comments:

Post a Comment